Many places are providing loan facilities to the residents of a particular county or state in the United States. Each program in the nation and every type of organization participating in it will do so to provide immediate needs to people around the place. Many people benefit from such programs. Each program is different and caters to the needs of a specific community or section of society whether it’s a private program or a government-aided program. In this article, we will find out what kind of CUP Loan program is run by the Federal Credit Union in Utah and how or what kind of people benefit from it.

What is CUP Loan by Federal Credit Union?

In the case of the CUP loan provisioned by the Federal Credit Union, the term CUP denotes Central Utah Project. Originally established in 1950, this program was established to bring benefits to Utah citizens.

What kind of benefits, you may ask?

It is primarily a Federal water project and was put in place to help the Utah people use a portion of the water from the Colorado River that flows through the state. It also puts impetus on the original members of the credit union ideally.

In 1960, the program began by serving workers of the Reclamation Bureau of the United States. The primary job of the reclamation bureau of the US is to oversee the management of the water resources in the country.

These thirteen hundred people CUP F.C.U open up to employees and family members of the Reclamation Bureau of the US and other four utility-related groups like the Electrical Service District, Central Utah Water Conservancy District and the Uintah Water Conservancy District, and Strawberry Water Users Association.

Who is Eligible?

Here’s how you can be eligible for the CUP F.C.U loans. First of all, you would be considered if you work with these above-mentioned five groups or if you are a family member of any of these groups. Next, check the below given criteria.

You need to be a citizen or a permanent resident of Utah.

Your employment details need to go into your application.

If your credit worth is not up to their needs, you might get rejected for a loan from them.

You must not submit any sort of misleading information to them.

Your purpose might match the purpose for which you seek a loan.

Also Read: What is CUP Loan Program in US & How to Apply for it?

What are the application requirements?

The application requirement for the CUP F.C.U will include these essential submissions.

- Your social security number must be added to the application.

- Housing type and pmt housing details have to go in the form.

- Employment details including the employer’s phone number need to be provided.

How to Apply for Cup Loan?

They have an application form, you can reach here through this link to start your application.

- The first segment is where you need to add your loan details including the type of loan you applied for reason, marital status, desired term, purpose, and amount for which you apply for a loan. State if you want to go for a credit life insurance or a credit disability insurance reason.

- In the personal details section, you will have to add your name, email, account number, social security number, birthdate, mother’s maiden name details, and also your home phone number.

- For the personal address segment, add the street, city, state, ZIP, housing, and housing pmt details.

- In the employment section, add the employer’s name, phone number, position, hiring date, monthly gross income, and other income details.

Once you have filled everything in, click on the send request tab to send your application for their review and approval.

How does CUP Loan by Federal Credit Union works?

After you submit the e-form, you must wait until their complete their review of your application.

They will review your application after they receive your credit points from your credit bureau, then they will determine your creditworthiness and then finally review the information you have put forth in your application with the sources and appropriate documents. They will also contact your supervisor on the same or connect with the office where you work.

When they can suitably match your information with the sources, they will go ahead and approve your loan which can take anywhere up to a week or two.

Find out more about the details by calling them to understand where they stand regarding your application.

Benefits

Benefits are many like a few jotted below for you to understand better about their loans.

- You can opt for a card or RV loan with them and not pay interest up to three full months.

- Vehicle loans for two years can be at an interest rate as low as 1.99%.

- RV loans are offered for 5-12 years and the rate of interest will vary from 7.39%-11.39%.

- Overdrafts will cost you a 14% interest rate.

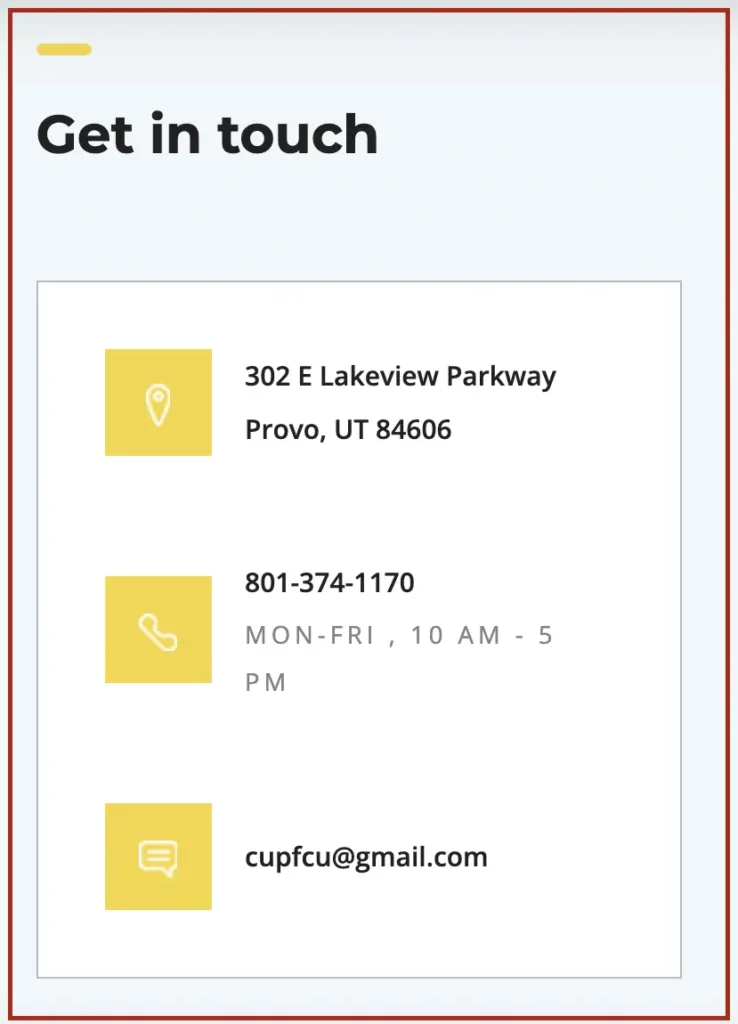

Contact Details

If you have any queries or want to ask anything related to the CUP Loan, you can reach them through any of the following means given in the below image.

FAQs (Frequently Asked Questions)

What is the official website for CUP loan by Federal Credit Union?

If you want to find out more about the official website and the details provided on the website you can visit www.cupcu.com

What are the Interest Rates & Fees?

Vehicle loans can be anywhere from a fixed term of 2-8 years spanned and the rate of interest can vary from 1.99% to 9.79%.

RV loans are offered for a span of 5-12 years and rate of interest will vary from 7.39%-11.39%.

Once you head to their site, you can click on the rates tab and then find out more about the interest rates from there.

Is CUP Loan by Federal credit Union Legit?

Legitimacy would be defined as anything that is not true to what they say. It is not like that with the CUP loans by the F.C.U. They are a credit union that practices the CUP loan plan and benefits those employed in the five different organizations.

How much loan can I get from the CUPFCU?

It is equivalent to 120% of the vehicle value for an interest period of 2-8 years. It would mean if your vehicle cost is $8000-$10000, you can get up to $12000 of the loan amount.

Conclusion

Everything you will want to understand about the CUP F.C.U loans is provided here. Apart from loans, they also help provide direct deposits, and savings schemes with checking or savings account options.

Electronic transfer facilities, wire transfer options, online and mobile banking opportunities, investment, and other savings options are also available with them for your convenience. If you are part of the five organizations, you will need the support of no other financial institution other than the Federal Credit Union help.

Author Profile

- Joe Jordan is a freelance writer with over 9 years of experience in his field. He possesses exceptional creative writing skills and extensive research abilities, particularly in finance-related topics. The primary objective behind launching this blog is to address user queries and provide clarity regarding the Cup Loan program.

Latest entries

CUP Loan ProgramMarch 28, 2024Plus American Savings CUP Loan Program 2024

CUP Loan ProgramMarch 28, 2024Plus American Savings CUP Loan Program 2024 CUP Loan ProgramJuly 27, 2023How to Apply for CUP Loan Program – Application Guide

CUP Loan ProgramJuly 27, 2023How to Apply for CUP Loan Program – Application Guide CUP Loan ProgramJuly 26, 2023Is the Cup Loan Program Legit or a Scam?

CUP Loan ProgramJuly 26, 2023Is the Cup Loan Program Legit or a Scam? CUP Loan ProgramJuly 10, 2023Cup Loan Program Reviews [Real User Reviews & Experiences]

CUP Loan ProgramJuly 10, 2023Cup Loan Program Reviews [Real User Reviews & Experiences]